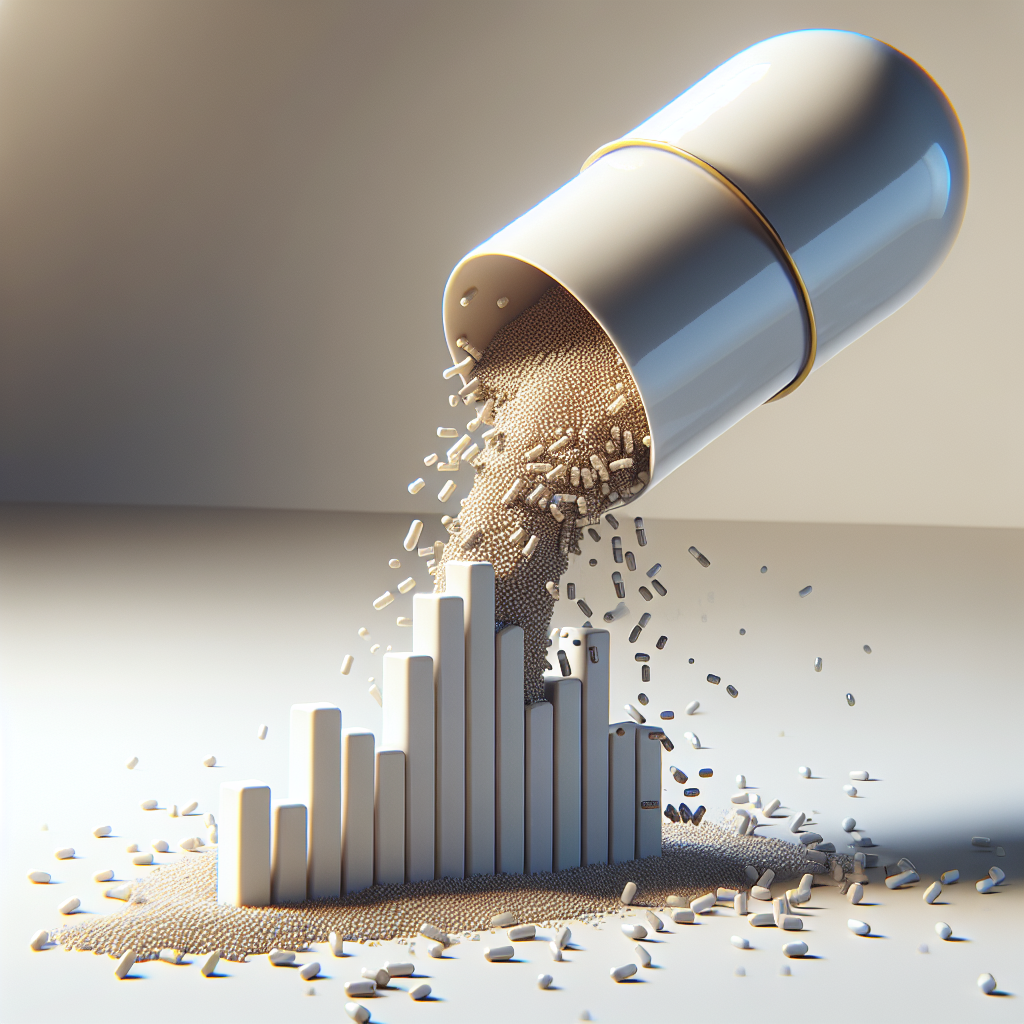

Medtronic’s Stock Drops on Inventory Hiccup: Analyzing the Implications for Investors

Medtronic PLC’s recent stock performance has raised eyebrows in the investment community, especially following a notable 7.3% decline on Tuesday, making it the worst performer in the S&P 500. This dip came after the medical-device giant reported results that, while showcasing an adjusted third-quarter profit exceeding analyst estimates, revealed a disappointing revenue figure that fell short of Wall Street’s expectations. This article will delve into the key factors affecting Medtronic’s current standing and what this means for investors in the pharmaceutical sector.

Key Financial Metrics From Q3

Medtronic reported a slight decrease of 0.4% in revenue within its medical-surgical unit, one of its primary business divisions that also includes neuroscience, cardiovascular, and diabetes segments. Chief Executive Geoff Martha attributed this dip to shifting U.S. distributor buying patterns, which resulted in a couple of hundred basis points impact on their surgical performance. This inventory challenge is expected to smooth out as they enter fiscal 2026, indicating a potential recovery on the horizon.

However, overall revenue for Medtronic grew nearly 3%, buoyed by strong demand for its advanced heart-surgery devices. Specifically, the company noted the success of its pulsed-field ablation (PFA) technology, which played a significant role in driving this growth. CEO Martha claimed, “We are starting to see the results from our long-term investments in groundbreaking innovation, such as pulsed-field ablation.” Medtronic reported adjusted third-quarter earnings of $1.39 per share, surpassing the FactSet consensus estimate of $1.36.

Market Reaction and Analyst Insights

The swift decline in Medtronic’s stock has surprised some market analysts. Jeff Jonas, a portfolio manager at Gabelli Funds, pointed out the drop as unexpected given the “tiny miss” on organic revenue growth, suggesting that the inventory setbacks, while disappointing, shouldn’t be regarded as a significant concern moving forward. He noted that, although management should have better anticipated these fluctuations, the primary issues are likely isolated and not reflective of long-term challenges for the company.

Looking at the Future: Earnings Projections

Despite recent setbacks, Medtronic continues to forecast adjusted earnings per share for fiscal 2025 to be in the range of $5.44 to $5.50, slightly at par with the average analyst estimate of $5.45. The company also maintains an optimistic outlook for revenue growth between 4.75% to 5% for the upcoming fiscal year, driven by what they describe as a “strong trajectory of our growth drivers and expected acceleration in the cardiovascular portfolio.”

Growth Potential of Pulsed-Field Ablation

Pulsed-field ablation is emerging as a transformative technology in the cardiovascular sector, utilizing high-amplitude pulsed electrical fields to treat arrhythmias effectively while minimizing complications, such as stroke. Medtronic anticipates this segment could represent a $2 billion business in the near future and forecasts a potential market size of $9 billion, boasting a growth rate in the high teens. This positioning aligns well with increasing global demand for safer and more effective treatment solutions in cardiology.

Operating Margins: A Positive Trend

Moreover, Medtronic succeeded in enhancing its adjusted operating margin by 100 basis points to 26.2%, showcasing operational efficiencies that surpassed their initial expectations. Such improvements in profitability metrics could present a silver lining, emphasizing the company’s ongoing commitment to innovation and cost management within its operational framework.

Conclusion: Evaluating Medtronic as an Investment

In summation, while Medtronic’s recent challenges have resulted in a stock price decline, the company’s underlying fundamentals remain robust. The slight revenue miss, driven by a temporary inventory issue, seems to be manageable in a broader context, especially when considering the strength of its innovative products, particularly in the cardiovascular arena. Investors should take note of the company’s forecasts and strategic positioning in emerging markets like pulsed-field ablation, which could serve as a significant growth driver moving forward.

For long-term investors, the current downturn could be perceived as an opportunity to reconsider the valuation of Medtronic, particularly considering the anticipated recovery in performance as they address inventory management challenges. As always, assessing both market trends and company-specific developments will remain crucial in making informed investment decisions in the ever-evolving pharmaceutical landscape.