The Weight-Loss Drug Market Is Heading for a Reckoning This Week: What to Expect

The monthslong battle over the future of the weight-loss drug industry is poised for a critical juncture this week, as the Food and Drug Administration (FDA) prepares to announce whether Eli Lilly’s obesity drug, Zepbound, can meet U.S. demand. This decision, set to be revealed on Thursday, will likely hold significant ramifications for both Eli Lilly and its main competitor, Novo Nordisk. Furthermore, the extensive ecosystem of telehealth companies and compounding pharmacies selling legal copycat versions of Zepbound and Novo’s Wegovy is also on the line.

If the FDA concludes that Zepbound is not in shortage, both Lilly and Novo can expect some relief, as this may lead to the eventual decline of the copycat market, compelling patients to purchase the higher-priced branded drugs. Conversely, should the FDA identify Zepbound as experiencing a shortage or delay the final verdict, investors may need to contemplate the genuine financial threat posed by less expensive alternatives from the compounding market. In recent months, shares of both companies have suffered, with Lilly’s stock down 15% and Novo’s American depositary receipt down 22% over the past three months, as Wall Street reassesses the projected demand for these GLP-1 weight-loss solutions.

A Paradigm Shift in the Weight-Loss Drug Market

The initial enthusiasm surrounding enormous peak sales estimates for Lilly’s and Novo’s weight-loss drugs has faced increasing scrutiny as complexities unfold within the market. Analysts initially based their optimism on the notion that high obesity rates combined with a highly effective obesity drug would inevitably lead to astronomical sales figures. However, the reality is far more complex.

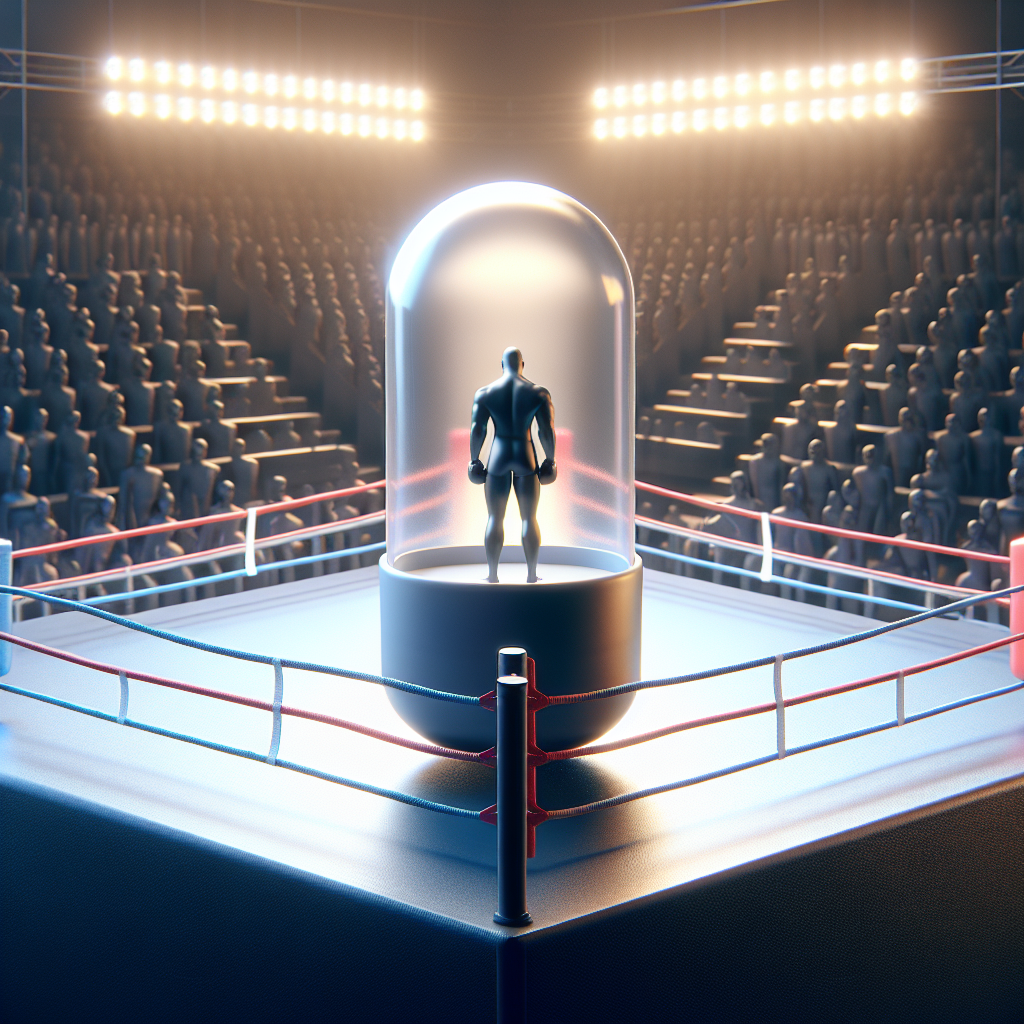

One of the most significant challenges now confronting Lilly and Novo is the emergence of compounding pharmacies. Under federal law, these pharmacies are permitted to create their own versions of a branded medication when the FDA classifies the branded drug as being in shortage. This presents a scenario where the increasing shortages of Zepbound and Wegovy have allowed an entire market focused on affordable alternatives to sprout up.

Explosion of Telehealth and Compounding Pharmacies

The increase in telehealth sites marketing compounded GLP-1 drugs has surged over the past year, creating a competitive landscape that appears reminiscent of a gold rush. Established names like Hims & Hers and Ro have been joined by numerous new startups. These platforms are selling compounded semaglutide (the generic version of Wegovy) and compounded tirzepatide (the generic version of Zepbound) at significant discounts compared to their branded counterparts. Consumers usually cannot apply their insurance to cover compounded medications, yet the lower prices make them attractive alternatives.

Companies’ Adaptation Strategies

In response, both Eli Lilly and Novo Nordisk have taken preliminary legal and regulatory actions against the growing compounding market. Nonetheless, they seem to recognize that these competitors are likely to remain a fixture in the landscape. Recently, Lilly struck a deal to offer a version of Zepbound through Ro’s platform, demonstrating its readiness to engage with online market dynamics. Patients can obtain single-dose vials of Zepbound filled through LillyDirect for $399 to $549 per month, a price point that sits lower than traditional retail pharmacy prices for Zepbound.

The FDA’s Dilemma

This pivotal announcement from the FDA comes after a back-and-forth process that has left stakeholders uncertain about the future of the market. In November, the FDA informed a federal judge that it needed further time to reassess whether tirzepatide is classified as being in shortage, further complicating the picture. Notably, the compounded tirzepatide’s availability appears to have diminished since the initial removal from the shortage list in October, with some telehealth providers halting sales entirely.

Should the FDA withhold a definitive answer this Thursday, the issue could be left over for a future administration, potentially favoring the compounders. For example, Dr. Marty Makary, the anticipated pick to lead the FDA in a new administration, serves as the chief medical officer at Sesame, a telehealth company selling compounded versions of Wegovy.

Conclusion: A Market in Flux

The upcoming FDA decision represents a crucial moment not only for Eli Lilly and Novo Nordisk but also for the larger pharmaceutical landscape surrounding obesity treatments. Investors should carefully monitor this situation, as the outcomes could dictate strategies for competition in the emerging telehealth sector and weigh heavily on the financial performance of these leading pharmaceutical firms. The interplay between traditional branded drugs and their compounded alternatives signals a broader shift in the pharmaceutical market, one that could have lasting consequences on pricing, availability, and access to effective obesity treatments.